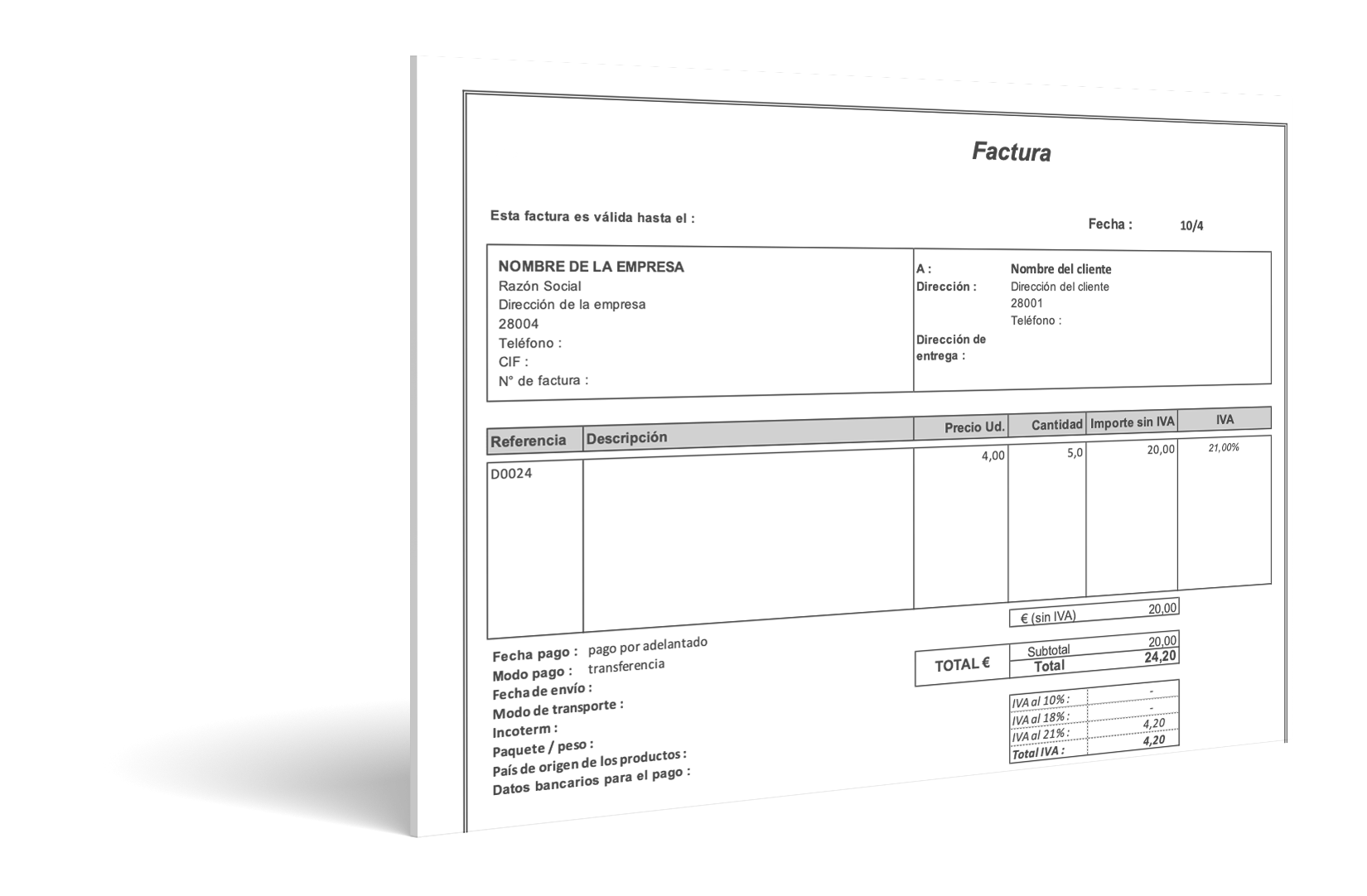

Immediate Supply of Information

Solution that facilitates the shift from the current VAT management system to a new bookkeeping system for

value added tax via the Spanish Tax Authority portal, by supplying invoice logs.

VAT management software supplying invoice logs

Peace of mind and benefits for your company with repcon SII for VAT management

The advantages to using repcon SII to automatically manage your company's VAT via the Spanish Tax Authority’s portal include:

Adaptability

Multi-ERP solution.

Capacity to associate the information to be provided based on your company’s business processes.

Agility

High capacity to automate all processes: automatic loading of ERP data, creation of logs, generation and sending of logbooks, management of Tax Authority notifications, etc.

Automatic software updates with new regulatory changes.

Security

Software on the cloud guaranteed by Semantic Systems.

Semantic Systems Spanish Tax Authority Partner.

Local

Tracking, training and support.

Local supplier (Derio-Bizkaia, Spain).

Do you know what the new SII system is?

SII (immediate supply of information)

) is a new VAT management system offering near immediate delivery of invoicing logs to provincial council tax authorities.

Mandatory from 1 July 2017 (AEAT) and 1 January 2018 (provincial council tax authorities) for certain companies.

SII affects your company

COMPANIES (TURNOVER > 6,010,121.04€) |

CORPORATE GROUP FOR VAT PURPOSES |

CORPORATE REMEDE AFFILIATES |

VOLUNTEERS |

| FISCAL RESIDENCY | COUNCIL PROVINCIAL | INDIFFERENT | COUNCIL PROVINCIAL |

|---|---|---|---|

| COUNCIL OPERATION SIZE (previous financial year) | < = €10 million | > €10 million | > €10 million |

| PLACE OF OPERATION | Any | 100% Provincial Territory | < 75% Common Territory |

SOLUTIONS

Configurator for custom product

Immediate supply of information

Plant automation and control solution

Automation of logistical and financial processes

Order and offer generation (CPQ)