TicketBai is a project developed jointly

by the provincial council tax authorities and the Basque government.

Its aim is to implement legal and technical obligations in management and billing software for taxpaying companies allowing them to monitor their activities and financial earnings.

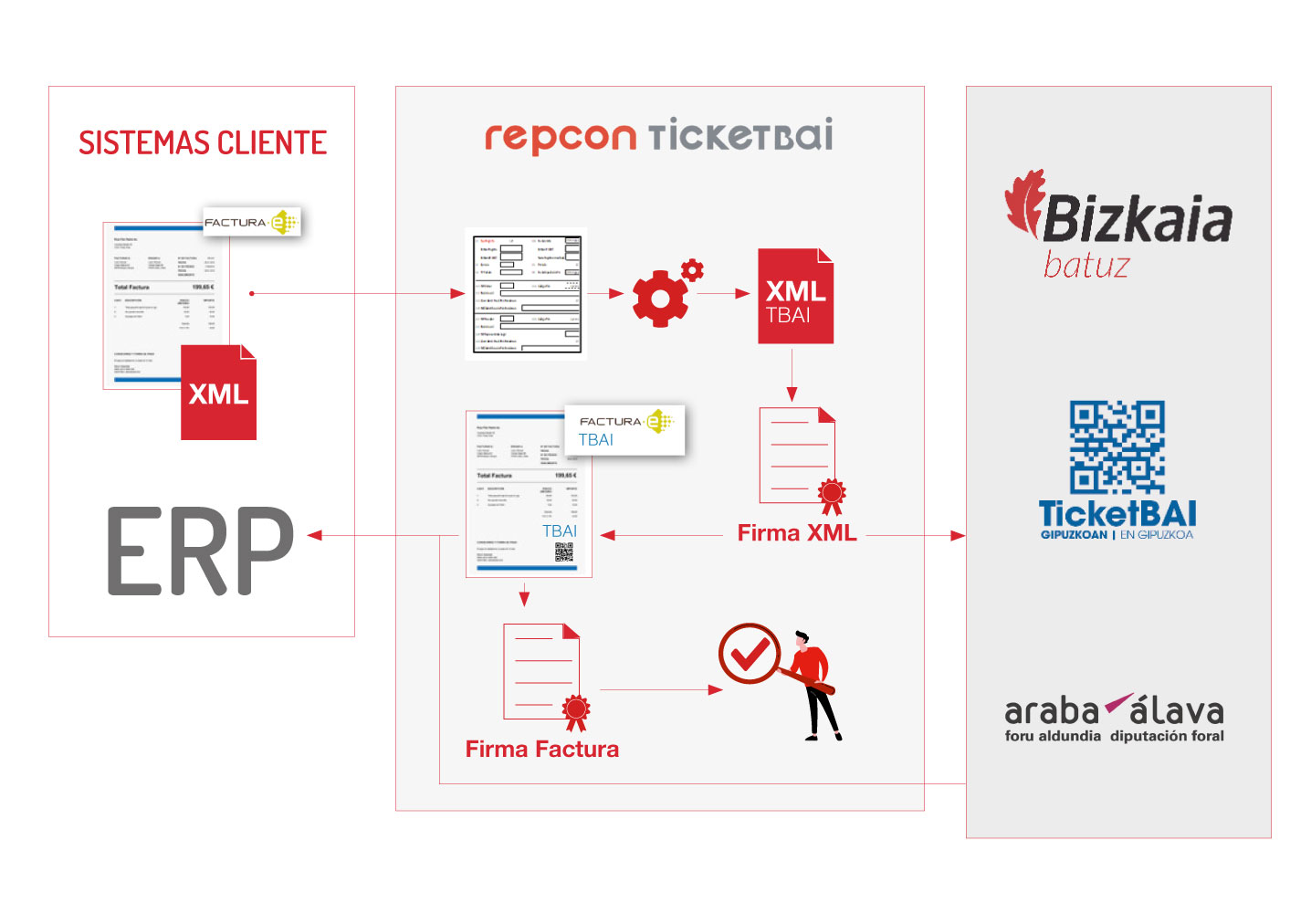

+ Informationrepcon TicketBAI The solution to comply with TicketBAI - Batuz regulations

The repcon TicketBai solution

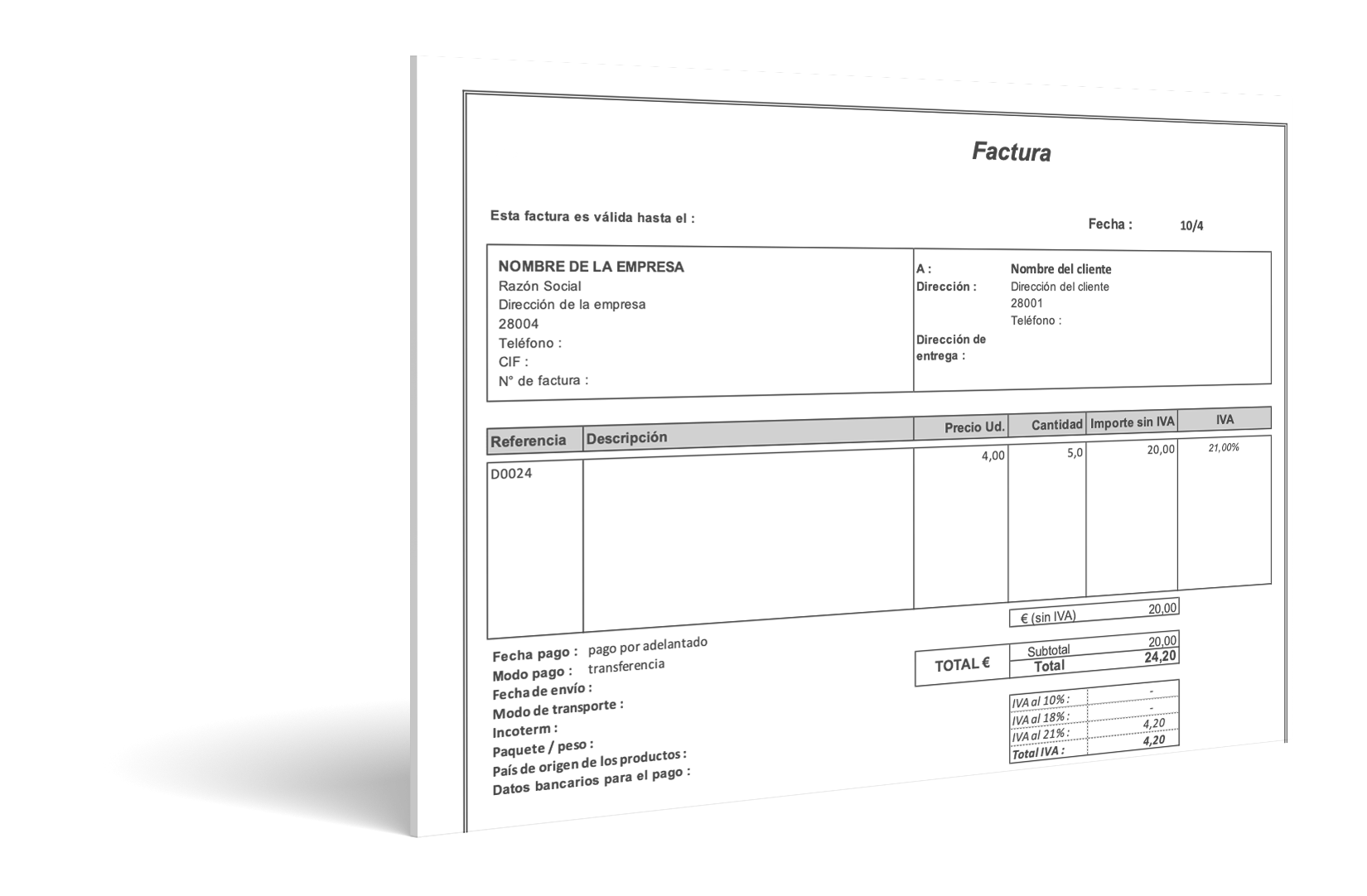

- TBAI file creation, signature.

- Dispatch to the corresponding provincial councils and notification receipt.

- Generation and signature of the invoice including TBAI code and/or QR code.

- Automatic sending of invoice to recipient.

- Automatic creation of log on LROE or SII.

- Process integrated in the customer’s ERP.

Why use Semantic Systems to manage TicketBai?

- Comprehensive, integrated multi-ERP solution.

- Based on repcon SII, the platform continuously adapts to new regulations.

- Experts in requirements and solutions, approved by the Spanish tax authority and provincial councils (repcon DPA Invoices).

- Technological partner with excellent know-how of ERPs Infor/SAP.

- Experience and strategic business approach in outsourcing heterogenous, complex systems with 24/7 availability.

- Customer-centric, highly adaptable and flexible.

Who is affected by TicketBai?

TicketBai:

Taxpayers in the IRPF (income tax) and IS (corporate income tax) jurisdiction of the regional tax authorities of the Basque Country.

LROE:

Anyone required to comply with SII and legal persons that do file VAT monthly.

When does it come into effect?

-

Voluntary date:

After 1 October 2020.

Mandatory date:

Starting 1 January 2024.

-

Voluntary date:

Starting 1 January 2021.

Mandatory date:

Starting 1 January 2022, it will be extended gradually by sector between said date and 1 December 2022.

Mandatory date:

Gradual implementation from January 2022 on, until all sectors are affected in October of the same year.

1 January 2022

Staggered rollout by sector in Gipuzkoa and Araba.

Subsidies, deductions and incentives (only applicable in the voluntary period)

PROVINCIAL COUNCIL RATE YEAR INVESTMENTS/DEDUCTIBLE EXPENSES BIZKAIA BIZKAIA (Batuz) 15% deduction on IRPF (income tax) or IS (corporate income tax) tax base for two years* 2022 and 2023 N/A N/A N/A N/A 30% deduction of IRPF (income tax) IS (corporate income tax) instalment** 2020 and 2021 YES YES YES YES GUIPUZKOA (TicketBai) 30% or 60% deduction *** of IRPF (income tax) IS (corporate income tax) instalment 2020 and 2021 YES YES YES YES ARABA (TicketBai) 30% or 60% deduction *** of IRPF (income tax) IS (corporate income tax) instalment 2020, 2021, 2022 y 2023 YES YES YES YES * Applicable only to SMEs joining on 1/1/2022. The percentage is reduced based on the date of implementation. ** Amounts not deducted due to insufficiency of the instalment in 2020 can be applied to returns for the following 30 years, provided the instalment is sufficient. *** Only if they implement during the voluntary period. SOLUTIONS

Configurator for custom product

Immediate supply of information

Plant automation and control solution

Automation of logistical and financial processes

Order and offer generation (CPQ)